Accrued Interest Payable Journal Entry

Accrued Involvement

The role of the involvement that has occurred, but the payment has not been made by the borrower all the same

What is Accrued Interest?

Accrued involvement refers to interest generated on an outstanding debt during a period of fourth dimension, but the payment has non all the same been made or received past the borrower or lender.

Summary

- Under accrual-based accounting, accrued interest is the amount of interest that has been incurred or earned in a reporting period, regardless of when it will be paid.

- The adjusting entry for accrued interest consists of an interest income and a receivable business relationship from the lender'due south side, or an interest expense and a payable account from the borrower's side.

- Accrued involvement in bonds refers to the interest that has been incurred but non paid since the last payment day of the bond interest.

Accrual Involvement in Accounting

Under accrual accounting, accrued interest is the amount of interest from a financial obligation that has been incurred in a reporting period , while the cash payment has not been made nevertheless in that period.

Accrual-based bookkeeping requires revenues and expenses to be recorded in the bookkeeping period when they are incurred, regardless of when the greenbacks payments are made. The accrual-based accounting method discloses a company's financial health more than accurately than the cash-based method.

The corporeality of accrued interest is posted as adjusting entries by both borrowers and lenders at the end of each month. The entry consists of interest income or interest expense on the income statement, and a receivable or payable business relationship on the balance sheet. Since the payment of accrued interest is generally made within one twelvemonth, it is classified as a current asset or current liability.

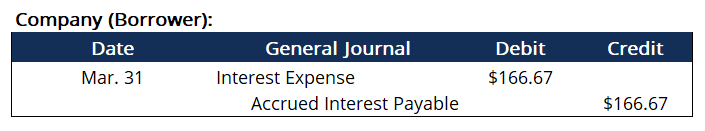

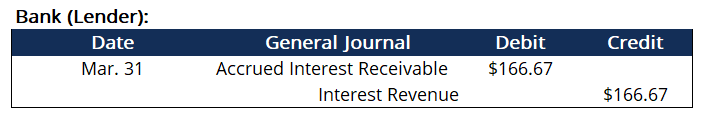

The borrower'southward entry includes a debit in the involvement expense business relationship and a credit in the accrued interest payable business relationship. The lender'due south entry includes a debit in accrued interest receivable and a credit in the interest revenue.

Accrual Involvement in Accounting – Example

For example, on March 21, a company borrows $100,000 from a bank at an annual involvement rate of 6%, and its beginning interest payment is due in 30 days on April xx. The annual interest is $six,000 ($100,000 * 4%), and the monthly payment is $500 ($six,000 / 12).

Assuming the bookkeeping period ends on March 31 for both the lender and the borrower, the interest payment incurred inside the period of March covers x days. Therefore, the accrued involvement for the accounting menstruation will be $166.67 ($500 * ten/30). The company and the bank's adjusting entries are shown below:

Accrued Interest in Bonds

Under the bond perspective, accrued interest refers to the office of the interest that has been incurred simply not paid since the last payment day of the bond involvement. Bonds tin can exist traded in the market every day, while their interests are usually paid annually or semi-annually.

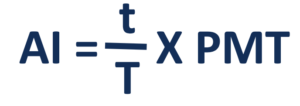

Accrued involvement occurs when a bail is non traded on its coupon payment date. It is the part of the interest that a bond heir-apparent gives upwardly from the last coupon payment engagement to the date the bond is bought. The corporeality of accrued interest can be calculated by the formula below:

Where:

- AI = Accrued interest

- t = Days from the final payment date to the settlement engagement

- T = Days in the coupon payment period

- PMT = Coupon payment of each period

There are two typical methods to count the number of days in a coupon payment catamenia (T) and the days since the last coupon flow (t).

I is the bodily/actual convention, counting the actual number of days, which is more often than not used for U.Southward. Treasury bonds and notes. The other ane is the 30/360 convention, assuming 30 days for a month and 360 days for a year, which is usually used for corporate bonds.

The amount of accrued interest should be earned by the bond seller. The quoted price in the bond market place, known as the clean price or flat cost, does not include whatsoever accrued interest. When a bond is traded between two coupon payment dates, its full cost (also known as dingy price), which is the present value of its future greenbacks flows, is the sum of two parts: the accrued interest and the apartment toll.

Accrued Interest in Bonds – Example

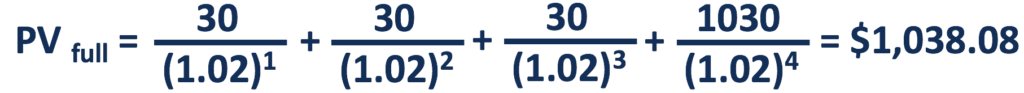

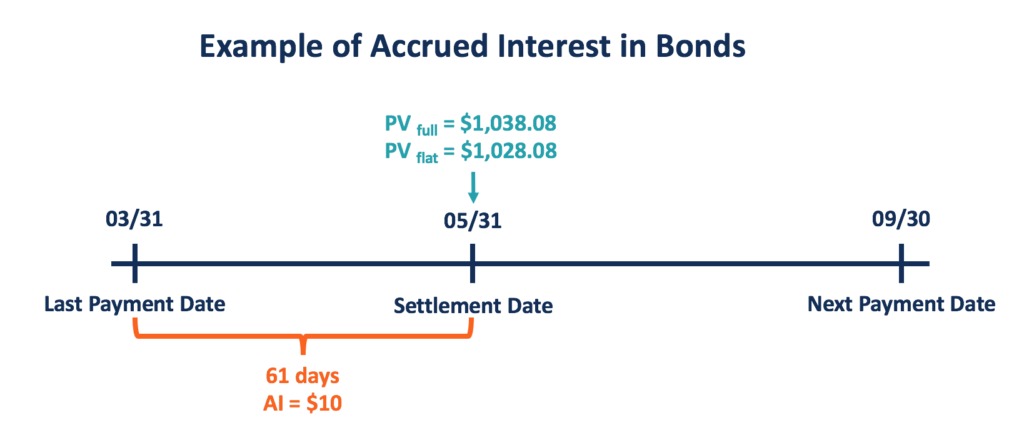

For case, a Treasury bond with a $one,000 par value has a coupon rate of half-dozen% paid semi-annually. The bond matures in two years, and the marketplace interest charge per unit is 4%. The last coupon payment was made on March 31, and the next payment will be on September 30, which gives a period of 183 days.

The coupon payment for each catamenia is $30 ([6%/2] * $one,000). If a trader buys the bail on May 31, the accrued interest will be $10 ($30 * [61/183]) with the actual/bodily day-count convention.

The full price will be the present value of future cash flows calculated as beneath:

The apartment price tin be calculated by subtracting the accrued interest part from the full price, which gives a result of $1,028.08.

Additional Resources

Give thanks yous for reading CFI's guide on Accrued Interest. To keep advancing your career, the additional resources beneath volition be useful:

- Accounting Transactions

- Coupon Rate

- Net Present Value (NPV)

- T Accounts Guide

Accrued Interest Payable Journal Entry,

Source: https://corporatefinanceinstitute.com/resources/knowledge/accounting/accrued-interest/

Posted by: washingtontured1978.blogspot.com

0 Response to "Accrued Interest Payable Journal Entry"

Post a Comment